INVESTMENT MARATHON #13 • September 2023

The building blocks of Aspira Wealth’s long-term investment strategy.

Newsletter by Alex Vozian, CFA, Co-Founder and Associate Portfolio Manager

Subscribe to our newsletters here.

Overwhelmed with something?

Running away is one great option to feel better. I have tried it, and it worked, again!

SUMMARY

- Canadian and U.S. markets update – The “20!30! buy” strategy

- Performance update

- Featured holding – Intuit Inc. (INTU)

- Two ways to worry less about the stock market news – Fight and flight

CANADIAN AND U.S. MARKETS UPDATE (2023-09-12)

The recent recovery of the stock markets made me think, again, about the following.

A great time to add new money to the stock market is when the market drops about 20 per cent from the previous high. Even better buying opportunity is when the market is down around 30 per cent, although such opportunities are less frequent!

Why not remember this strategy as “20!30! buy strategy for the additional investments”?

The regular investor doesn’t have the courage to do so, or even worse, they do the opposite – sell instead of buying. It is tempting to sell in those circumstances because most of the economic news and reports are very negative – full of depressing words like “recession, bear market, crisis, losses, earnings below expectations, unemployment, etc”.

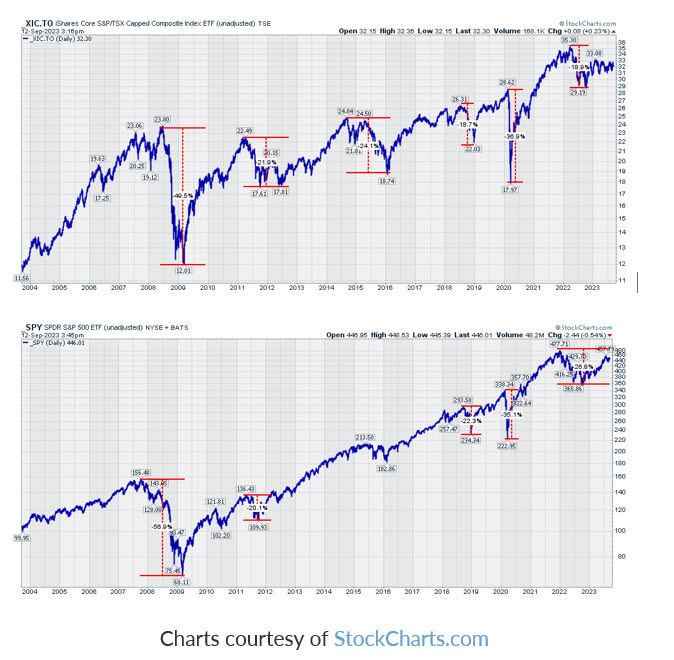

In the charts below, I have marked all declines around 20 per cent and more, from previous highs, for both Canadian and the U.S. stock markets.

Main observations:

- In the past 20 years, the markets have declined over 18 per cent for 5-6 times

- If one bought the market right after a 20 per cent drop, they were in profit position within months (worst case scenario in two years)

PERFORMANCE UPDATE (2023-09-12)

Most of our in-house investment strategies ended the years of 2021 and 2022 with significantly better results than the market averages.

In the first eight months of 2023, our primary investment strategy, The Dividend Value Discipline™, performed in line with the broad market indices, after lagging significantly in early 2023. Patience (i.e., running!) and diversification have helped.

You will see the detailed performance update in our Quarterly Compass publication in early October 2023.

FEATURED HOLDING – INTUIT INC (INTU)

Intuit Inc. (INTU) is a global financial technology platform known for products like TurboTax, Credit Karma, QuickBooks, and Mailchimp. INTU serves 93 million consumers and 10 million small businesses and self-employed individuals, primarily from the United States. Just about eight per cent of the revenues are international.

We discovered, studied, and bought the initial position in INTU in late 2015. Our internal estimates of quality are quite attractive for INTU. In fact, INTU is among the top three names owned in the portfolio based on our estimated quality score:

- GREAT MANAGEMENT – We admire the long tenure of the leadership team, promotions from within, large insider ownership, long-term focus, and employee satisfaction.

- WIDE ECONOMIC MOAT – Competitive strength originates from the large scale, switching costs, intangible assets, and network effects. The economic moat is confirmed by solid free cash flow margin.

- MIXED INDUSTRY TAILWINDS

- Tailwind: INTU is enjoying the tailwind of digitization and shift to cloud/online.

- Headwind: A threat of a government-run free-file program. While it sounds as an existential threat to a company involved in tax preparation services, we assume that impact will be limited.

- It is related to the consumer segment of INTU – i.e., not to the entire company.

- Free-tax preparation services might be appealing to low-income customers (and they already have had multiple free-tax filing options for years).

- The higher income customers, however, might not be satisfied by the features of the free-tax filing program. On top of this, they are able and willing to pay for a third-party alternative instead of relying on a government-run program.

- ESG – The environmental, social and governance score of INTU is very high and was recently upgraded by MSCI to AAA rating from the previous AA rating.

- DIVIDEND – Dividend has doubled in the last five years, including the 15 per cent increase from late 2022.

THE MAIN "PROBLEM" that we have with INTU is that the market value of its shares is approaching our estimated fair value, so we might consider selling or trimming it soon.

Two ways to worry less about stock market news

The 20!30! strategy (from the beginning of this letter) is applicable to investing new money.

When it comes to the money already invested in the stock markets, I recommend (and personally practise) both fight and flight strategies – to sleep well at night!

- Fight strategy (hardest of the two) – When I am forced to read an excessive amount of negative news, I try to defeat the negative news by focusing on the positives and opportunities.

- Flight strategy (easiest of the two) – Running away from the sources of negative news, as far as I can. In May-August 2023, I ran a total 360km including the final longest run of 42.3km.

1. Fight strategy

A good example is the current obsession with inflation fears. The fear could be summarized as follows:

High inflation will never go away. Even if it slows down this year, it will reaccelerate soon (second wave, third wave) as it did in the 1970s. Central banks will increase interest rates too much and will cause a massive recession.

There are several positive thoughts that could defeat inflation fears:

- Inflation continues to slow down.

- Central banks across the world have raised interest rates to fight inflation. It normally takes some time for the full effect.

- There is still an option for central banks to do another (final) 1-2 interest rate hikes (if need be) to eliminate inflationary pressures.

- Today, central banks have access to more sophisticated and timely economic data points, compared to what they had access to in the 1970s, so the risk of policy error is likely smaller now.

- Inflation of 2021-2022 was fuelled by confluence of unprecedented forces – all of these are largely gone today:

- Supply was decimated by the worst supply chain issues in decades during the pandemic (it was hard to produce and deliver goods, as well as to provide services).

- Demand for goods and services was turbocharged by social assistance related to the pandemic.

- Many consumers had more free time to shop (less time was spent on commute and on work).

- Many consumers just needed to shop – anxiety is known to increase impulsive shopping – to feel at least some joy and control in difficult situations.

- Bonus thought: If we are completely wrong in our thinking, and inflation significantly accelerates, then we could still do ok in the long run:

- Equities (particularly wide moat companies) are performing better in inflationary environment than fixed income/cash securities (most of our clients have 70%+ exposure to equities and less than 30 per cent in fixed income/cash)

- Aspira Wealth doesn't shy away from tactical exposure in materials and energy sectors, where we see inflation as most likely. The strenuous and indiscriminate fight against mining and energy sector has led to massive underinvestment in:

- Relatively clean sources of energy (natural gas and nuclear compared with coal and oil)

- Strategic materials needed for energy transition – rare earth metals for EVs and batteries, copper for the power grid

2. Flight strategy

I have been fascinated by psychology since high school, and I finally carved out some time to dive deeper into this field in the past six years. I read several great books and took several courses in the field of human behaviour and how our minds work.

One takeaway is clear – humans are often too anxious about something, and that is totally natural! Our ancestors who didn’t worry about anything were sifted by natural selection. While being vigilant was important for survival, it is becoming counterproductive in modern days – and it is exploited by the news industry because people automatically pay attention to negative news.

It takes a calm mind to make the wisest decisions in life (and in investments too!). It is hard to stay calm, however, for a long time when most news is focused on the negatives, and it gets even worse when you are struggling with some health or family challenges.

I found it very helpful to apply the flight strategy when the fight strategy wasn’t leading to great results. It is a very simple approach – you just have to run away from your negative thoughts – ideally by doing an outdoor aerobic activity that you enjoy the most – running, hiking, walking, participating in team sports, swimming, etc.! To relax your mind, you may want to exhaust your body.

Back in May 2023, I decided to restart running to restore my balance and equanimity. It took 18 weekly sessions to extract all the positive results.

The most exciting parts of those runs were:

- All weeks – continuous improvement in my wellbeing both at home and work; taking hundreds of pictures with sunrises from multiple beaches of Victoria; listening to multiple hours of podcasts and books, and much more!

- Week 14 – accidentally discovering a simple way to finally fix my knee pain during runs that was bothering me for years (three physiotherapists couldn’t help with that).

- Week 18 – running (and surviving) my first marathon ever in August 2023 – 42.3 km – from home to work

- … and like in the past, investment performance improved, too (!), as I was better able to ignore the short-term negative noise.

PLEASE REACH OUT

Let's chat about what is on your mind and the puzzles you are trying to solve.

- Schedule a meeting with Chris or Alex.

- Send your questions by email to Chris or Alex.

- Learn more about us by checking out our team’s page and the founders’ video.

- Read our earlier publications here.

- Subscribe to our newsletters here.

It is our mission to help our clients live out their greatest aspirations!

FIND THIS LETTER HELPFUL?

Don’t keep it a secret! Forward it to one or more friends and colleagues.

Sunrise at Oak Bay Marina, from one of my August 2023 runs.

The information contained in this report was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete and it should not be considered personal tax advice. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd., Member—Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.