THE QUARTERLY COMPASS - ASPIRA WEALTH – June 30, 2024

In-depth stock market analysis from your wealth advisory team - Aspira Wealth from Victoria, B.C. Written by Alex Vozian, co-founder and associate portfolio manager of Aspira Wealth.

HOW DID THE CANADIAN AND U.S. STOCK MARKETS PERFORM IN THE SECOND QUARTER OF 2024?

Stock markets of Canada and the U.S. were mixed during the second quarter of 2024. A few companies with exposure to artificial intelligence (AI) continued to outperform the market indexes, while most companies underperformed.

There are signs of economic slowdown in multiple countries, inflation is still lingering above the target, and the fiscal policy is getting more uncertain (U.S. elections, French elections).

We continue to believe that U.S. and Canadian stocks are the best investment class for the long-term investors.

INVESTMENT PERFORMANCE – ASPIRA WEALTH IN-HOUSE STRATEGIES – RJL only

Performance reported below does not include RJLU numbers, due to compliance reasons. For RJLU clients, please check your individual accounts for performance reporting.

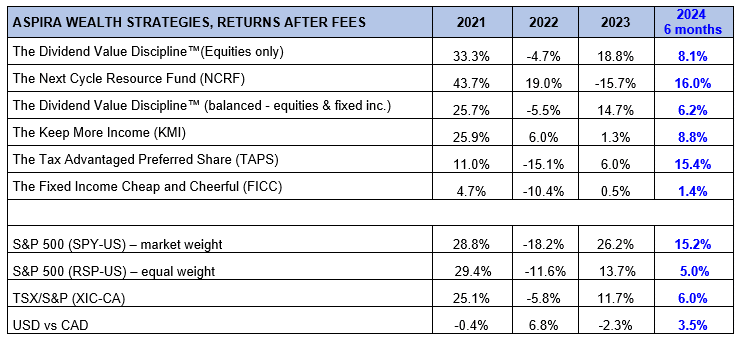

In the first half of 2024, the investment strategies of Aspira Wealth performed well – particularly relative to the equal-weight benchmarks. All strategies generated a return between 6% and 16%, except for the fixed income strategy (FICC) that generated a 1.4% return.

Our flagship strategy, The Dividend Value Discipline (TM), returned 8.1% in the first half of 2024. That is a great result when compared to 6.0% return of the Canadian stock market (XIC.TO) and 5.0% return of S&P 500® Equal Weight (RSP). The S&P 500® Market Weight index (SPY) returned 15.2% in the first half of 2024, and it did so due to a few companies with exposure to artificial intelligence (AI).

We place no weight on short-term results, good or bad, and neither should you. We believe that our long-term focus will serve us better.

Source: Aspira Wealth. *These numbers are relevant only for accounts with Raymond James Ltd. (Canada).

BROAD MARKET OBSERVATIONS

CANADIAN STOCK MARKET

- The Canadian stock market did not move a lot during Q2 2024, following a strong rally in the previous six months.

- Bank of Canada started cutting interest rates in 2024 after seeing progress with lowering of inflation rate. This is welcome news for a country experiencing economic slowdown and rising unemployment. While lower interest rates are a positive for the stock market, it was expected, and priced in, before the 25bps interest rate cut.

- The likelihood of a 5-10% decline in the market has remained the same or perhaps even increased since our last update. We intend to be more cautious with buying during the next 3-6 months while keeping our long-term positive bias. If market does contract 10% later this year, we plan to:

- Encourage clients to seize the opportunity of buying more at cheaper prices.

- Discourage clients from selling their investments in panic.

Chart courtesy of StockCharts.com

U.S. STOCK MARKET

- The United States stock market (market-weight S&P 500) performed significantly better in Q2 2024 compared to Canadian market.

- The strength, however, was not broad based. While the market-weight index of S&P 500 (SPY) was UP 4.4% during Q2 2024, the equal-weight index S&P 500 (RSP) was DOWN 2.6%. In more simple terms, a very few large companies had a massive outperformance, while most companies declined during the quarter.

Chart courtesy of StockCharts.com

USD CAD Exchange Rate

- Over the past 30 years, the Canadian/U.S. dollar exchange rate was quite volatile, but it spent half of the time within the 1.20-1.50 CAD/USD range, including the last nine years.

- We assume that, over the long run, the exchange rate between CAD and USD will remain range-bound, having a neutral effect for Canadian investors with exposure to stocks listed in the U.S., and for U.S. investors with exposure to Canadian stocks. Our assumption is based on the depth of economic connection between Canada and the U.S., as well as economic policy similarities.

- We will continue to allocate 50-75% of exposure to U.S. stocks, to not be limited by the undiversified Canadian stock market.

Chart courtesy of StockCharts.com

Copper Price – one of the world’s leading economic indicators

- Copper price is assumed to predict turning points in the global economy, since it is widely used in most economic sectors. The current price level is not sending a clear positive or negative signal, as it remains volatile since 2021.

- The copper price exceeded our $5 forecast from mid-May 2024, and then retracted to around $4.5.

- We continue to believe that long-term fundamentals of copper are great and expect copper prices to exceed $5 level during the next three years. New copper deposit discoveries are limited, while the world needs a lot of copper to build and to power electrical vehicles and as well as artificial intelligence data centres worldwide.

Chart courtesy of StockCharts.com

Semiconductor stocks – one of the world’s leading economic indicators focused on the “new” economy

- Semiconductor stocks are reflecting what is happening in the most advanced parts of the economy.

- Semiconductor stocks did really well lately, as seen in the chart below. Some volatility is to be expected in 2024 after the solid gains that started in early 2023.

- The recent strength is driven by the AI race, push for semiconductor independence, self-driving car technology/infrastructure, investments in industrial automation, etc.

- We are participating in this space, through several holdings in The Dividend Value Discipline (TM) strategy.

Chart courtesy of StockCharts.com

Crude oil prices

- In Q2 2024, the U.S. oil price (WTI) traded mostly in the $70-80 range.

- We continue to expect U.S. oil price (WTI) to remain volatile but stay in the wide range of $60-100 per barrel.

- We think it is unlikely to go below $60 during the next five years, considering the low investments in production capacity in the past 10 years.

- We do not expect it to go above $100, because higher prices encourage larger supplies and given the continuous efforts to transition to cleaner energy.

Chart courtesy of StockCharts.com

U.S. natural gas price

- S. natural gas price did not stay long under $2.0, as we expected. In Q2 2024, the price of natural gas jumped from the multi-year low of $1.5 to as high as $3.2 and is now trading around $2.4.

- We expect it to stay in a wide range of $2-5 per MCF during the next five years (the natural gas prices are oscillating more than oil prices, due to exposure to the weather/heating season). Given the North American growing export capacity and global transition away from coal/oil, we are biased to the upside.

Chart courtesy of StockCharts.com

WORRY JOURNAL - TOP WORRIES OF MARKET PARTICIPANTS AND BUSINESS LEADERS IN 2023-2024

New worries:

- S. elections: Elections are often a big concern for businesses and investors – since they are affecting so many assumptions that business owners and investors are making for the near term. Current election campaign in the U.S. is similar to earlier ones when it comes to the amount of uncertainty. The latest Biden-Trump debate did not help either and we do not expect it to get better until the end of 2024.

- We assume that both candidates are far from ideal for the population and for the business/investment environment. Aspira Wealth portfolios are diversified enough to do well regardless of who is elected for the next four years.

- Delay in U.S. interest rate cuts: In early 2024, the market participants were expecting U.S. Federal Reserve to implement three interest rate cuts during 2024, while the latest expectations are to have one cut or even none this year. It proved once again that predicting short-term economic events is a pointless exercise.

- The great news is that we do not rely a lot on those expectations while building and adjusting Aspira Wealth portfolios. Also, the U.S. Citigroup Economic Surprise Index has been negative for a couple of months, increasing the probability of interest rates cuts in U.S.

- Artificial intelligence (AI) bubble: In our past letter, we discussed the potentially disruptive effect on our daily lives from the launch of AI, as well as the risk of overinvestment in that field. In the last three months, we saw an increasing excitement around AI and how AI boom is poised to benefit even some construction and cooling equipment companies (!), not just the suppliers of chips, memory, and networking equipment.

- We own several beneficiaries of the AI boom, that we were able to buy at reasonable prices, mostly before the AI boom. We plan to keep a smaller exposure to this investment theme compared to the weight of AI beneficiaries from U.S. market-weight index S&P 500, recognizing that every boom is eventually followed by a bust.

Older worries covered in detail in our recent publications:

- Nothing to fear but nothing to fear (2024).

- Risks and Dangers of Artificial Intelligence (AI) (2023+).

- 2023 Israel–Hamas war (2023+)

- Economic slowdown/recession (2022+)

- Debt ceiling debate/potential of a U.S. default (2023)

- War in Ukraine (2022+)

- Inflation (2021+)

- Supply chain disruption caused by the pandemic, geopolitical events (2020+).

- Labour shortages, attracting and retaining talent (2020+).

PLAYBOOK OF OPPORTUNITIES – HOW WE SEIZE THE CURRENT OPPORTUNITIES

Broad equity market level: We maintain our long-term optimistic bias, while looking forward to some volatility in the short term. The recession fears have peaked in 2022 and completely disappeared by the start of 2024. This might be a signal that a recession will happen. Even with that insight, we must recall that far more money is lost preparing for the recession than during the recession. Economic slowdowns are part of the price we pay for equity type returns over extended periods.

Our economic sector biases are listed below:

- Over-weight cyclical sectors – technology, energy.

- Equal-weight – industrials (downgraded), consumer discretionary (downgraded), materials (downgraded), financials.

- Under-weight - consumer staples (downgraded), healthcare (downgraded).

- Avoid - utilities, REITs.

SECTOR POSITIONING FOR THE DIVIDEND VALUE DISCIPLINETM

TECHNOLOGY SECTOR - Long-term positive. Caution around AI names.

- Assumptions: Sector to continue to grow above GDP level. The sector is now more mature/profitable vs. 20+ years ago, so we expect future cycles to be significantly less volatile compared to the dot-com bubble. Near-term tailwinds are coming from the AI arms race and push for semiconductor independence.

- Observations: High profit margins and cash flow generation. Low capital-intensity. Sells mostly productivity tools and solutions that are always in demand. After outperforming in 2014-2021, under-performed 2022 because of increasing interest rates and irrational capacity expansion during the pandemic. Significantly outperformed the market since early 2023, particularly companies benefiting from the AI arms race.

INDUSTRIAL SECTOR - Medium-term neutral. Long-term positive.

- Assumptions: Sector might grow above GDP level in the long term - driven by under-investment in infrastructure and in residential real estate; also, from the required investments for transitioning to green energy and onshoring of critical technologies. Slower-than-expected cuts in interest rates is a short-term headwind for the sector.

- Observations: Industrial sector witnessed major tailwinds and relative out-performance until 2008, helped by growth of China and other emerging markets, as well as from the housing bubble in the U.S. Those tailwinds ended around 2008. The U.S. industrial sector underperformed significantly in 2018-2019 as several countries started rejecting globalism and embracing patriotism (e.g., U.S.-China trade wars), further deteriorated by lower capital investment during the pandemic. Global economic slowdown did not help in 2023. In Q1 2024, sector outperformed in line with our expectations, but significantly underperformed in Q2 2024.

CONSUMER DISCRETIONARY SECTOR - Medium-term neutral

- Assumptions: We assume it is a suitable time to be equal-weight in the consumer discretionary sector, because of: (1) increasing signs of economic slowdown, (2) central banks are cutting interest rates slower than anticipated, (3) unemployment started increasing.

- Observations: Consumer discretionary sector is diverse and occasionally un-correlated holdings. This explains why it does not have a clear long-term trend. U.S. consumer discretionary sector outperformed from 2000, underperformed from 2005, outperformed from 2009, underperformed from late 2021, while seeing a couple of short-lived periods of outperformance.

BASIC MATERIALS SECTOR – Long-term positive. Short-term neutral.

- Assumptions: Multiple strong tailwinds in several segments of materials sector, particularly for industrial metals, uranium, precious metals: (1) energy transition and climate concerns, (2) extreme underinvestment in capacity growth, (3) sector out of favour for too long, including due to climate impact. We are now neutral in the short term, due to some signs of economic slowdown.

- Observations: Sector is diverse (industrial metals, precious metals, uranium, fertilizers and other chemicals). The sector underperformed after 2008-2009 as growth in emerging markets slowed down, further hit by trade wars, industrial recession, and pandemic. The sector performed in line with the broad market since 2021, until starting to underperform in 2023.

ENERGY SECTOR – Medium-term - mild positive

- Assumptions: We see pockets of opportunity within the Canadian and U.S. energy sector, based on following assumptions: (1) sector out of favour for too long. (2) sector is significantly more disciplined (focused on earnings and cash flow) compared to previous focus on growth-at-any-cost. (3) this discipline led to fewer exploration and capacity growth. (4) natural gas is cleaner than oil and coal. (5) transition to greener energy is requiring significant effort – including infrastructure, equipment and materials that require fossil fuels to be manufactured or mined. We continue to expect U.S. oil price (WTI) to remain volatile but stay in the wide range of $60-100 per barrel, while natural gas in $2-5 per MCF range.

- Observations: Last big round of outperformance of the energy sector was driven by record-high oil and gas prices. These in turn were driven by rapid economic growth in emerging markets until 2008. The sector was hit by the great recession of 2008-2009, over-production of 2014, trade wars of 2018, and pandemic/shutdown 2020, and gradually increasing fight against fossil fuels. In Q1 2024, the energy sector outperformed the broad market, as we expected, helped by higher oil prices, partially offset by lower natural gas prices. In Q2 2024, the sector gave up all the relative gains from Q1 2024.

HEALTHCARE SECTOR - Medium-term neutral. Short-term negative.

- Assumptions: In the long run, we expect the healthcare sector to perform in line with benchmarks, like it did since 2017. The favourable demographics (more old people in total population) is offset by an excessive (unaffordable) level of spending per capita, and recent promising results in diabetes/obesity medication space. Our sector bias is now short-term negative as the sector continues to surprise to the downside.

- Observations: The healthcare sector was outperforming significantly from 2011 until 2015. Large underperformance followed in late 2015 and 2016 because of uncertainties related to healthcare policies in the U.S. as the government was trying to slow the rapid rise of healthcare costs. The sector continued to underperform in Q2 2024 as it did since early 2023.

FINANCIAL SECTOR - Medium-term neutral.

- Assumptions: While the sector was struggling with old headwinds, a fresh major headwind hit the sector in 2023 (Silicon Valley Bank failure). We do not expect major investment opportunities in the long term as the sector might face continued/increasing regulatory pressures on top of legacy headwinds.

- Observations: Sector suffered massive losses relative to the broad market during 2007-2008. Profitability affected by losses from mortgage-backed securities as well as increased regulation and low interest rates. Eroding competitive power as fintech companies are attracted by high profit margins in the industry. The sector performed in line with broad markets in Q1 2024, as we expected, and then underperformed in Q2 2024.

CONSUMER STAPLES SECTOR - Medium-term negative.

- Assumptions: We see limited opportunity in participating in this sector: (1) companies often have slow growth and difficulties in expanding their profit margins; (2) everybody is expecting/discussing recession risk for ~2 consecutive years – a good time to stay away from defensive sectors like this.

- Observations: The 20-year return of the consumer staples sector is similar to broad market indexes. It usually outperforms the market in a recessionary environment; however, those periods are short. The sector continued to underperform in Q2 2024, as it did since early 2023.

COMMUNICATIONS SECTOR - Avoid (limited options)

- Assumptions: We see little opportunity in participating in this sector. (1) Legacy communication companies are slow growth or no growth, as their moat is eroding. (2) New generation of companies do not meet our dividend requirements. Even if they paid dividends, they are mostly mega-cap companies followed by dozens of analysts and investors - i.e., a very crowded space.

- Observations: Sector witnessed significant outperformance after 2008, led by a new generation of communication services companies (Google, Facebook, Netflix, etc.). Significant underperformance followed in late 2021 and 2022, due to the same holdings, as it happened with the technology sector. In 2023, the sector recovered half of the relative losses from 2021-2022. In the first half of 2024, the sector modestly outperformed the broad markets.

UTILITIES & REAL ESTATE (REIT) SECTORS - Avoid (too small and complicated)

- Assumptions: While we occasionally have short-term exposure to these sectors in other strategies, we avoid them in our core strategy, The Dividend Value Discipline.TM

- Observations: (1) Weak performance due to slow growth, (2) Complex, heavily regulated sectors, (3) Huge sensitivity to interest rates, (4) Clients already have significant exposure to residential and commercial real estate.

Alex Vozian, CFACo-Founder and Associate Portfolio Manager Aspira Wealth