Special Market Dispatch, Monday, January 6, 2025 – The Theme for 2025? Disruption!

I write this missive on the third day of trading for 2025 and the first day when most of “the street” is back at work. My last dispatch of August 6, 2024, Market Downdraft: Problem or Opportunity? It Is All About One’s Behaviour was telling. Suffice to say that our strategies and the markets ended the year significantly higher.

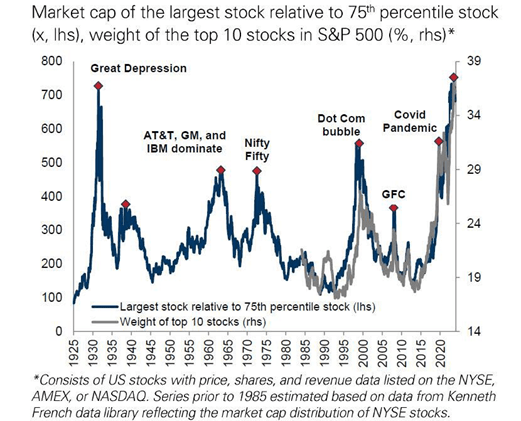

Notwithstanding the double digit returns across most of our accounts for 2024, December was actually a pretty tough month - in short, the S&P 500 blasted through record high concentration levels and the Trump Bump fizzled on pretty much everything else.

We witnessed a significant deterioration in investor sentiment throughout December. The CNN Fear & Greed Index closed out November at 67 GREED and by December 19, it had hit the 22 EXTREME FEAR. As I write we are back to 37 FEAR. Yes, a lot of optimism has evaporated and that is just fine with us. The best opportunities tend to coincide with multiple days/weeks of extreme fear levels.

Observations That Continue to Concern Us

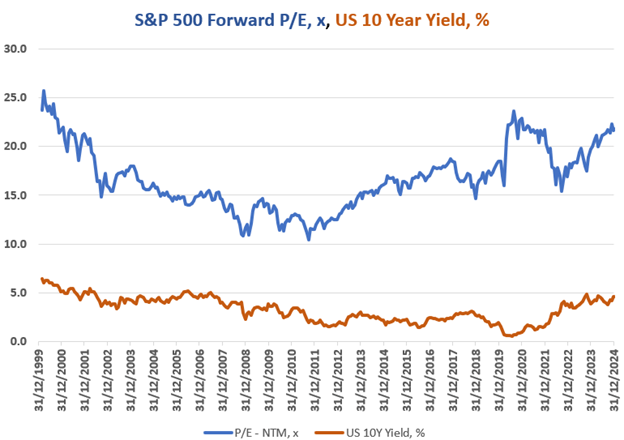

- The forward price to earnings multiple (the inverse of the earnings yield) for the S&P 500 stocks is at record highs and was only exceeded during the dot.com bubble and Covid, the latter when the interest rates were miniscule – that is not the case today.

Source: Aspira Wealth of Raymond James.

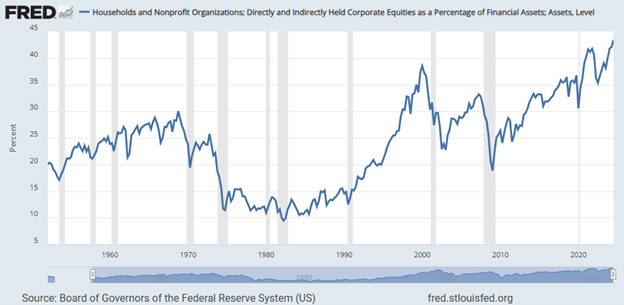

- The retail crowd is heavily weighted in Nvidia (and pretty much anything else with an AI theme) - the retail crowd is seldom right. Furthermore, the household allocations to stocks have never been higher. Take note of the chart at peak dot.com era.

- The top 10 stocks now reflect a record high concentration level of 40% of the S&P 500's market cap – such concentrations have not ended well.

Chart Provided by Barchart.com

Observations That Give Us Cause for Optimism

- The investment theme for 2025 is going to be Disruption and we welcome it with open arms. Regardless of which way you lean politically, it is obvious that there is going to be sea change on how the governments of Canada and the US are going to be run in the years ahead. The rules for entire industries are going to get re-written as new administrations take over. Trump is a certainty; Poilievre seems to be a near certainty.

- Our counsel for investors this year is please do not underestimate the favourable winds of de-regulation. One thing that both leaders are committed to is to shrink the size of government and allow the private sector to flourish. It is only with the latter that we can grow our way out of our debt problems. Entire industries are going get re-valued, up and down. There will be lots of opportunity and much of it in industries that have attracted little capital in recent years.

- For Canadian investors, recognize that no industry has been more maligned by its federal government than Canada’s oil and gas sector has been for the last 10 years. That is very likely going to change in a significant way. If you are interested in what Poilievre’s intentions are this podcast (Apple, Spotify) will give you a sense of where he intends to take the country. You do not have to agree with him – that said, I do believe it is important to understand the vector.

Summary Thoughts As We Enter 2025

We are encouraged by the diversity of our research and our strategies offered. Like most years, there will be bumps in the road and more often than not, those bumps turn out to be opportunities. We see 2025 as being more bumpy than usual and that is how we expect it to shine.

Alex will be back to you next week with the Q4 2024 Quarterly Compass with a much more in-depth report and where we landed performance-wise with each one of our investment strategies.