THE QUARTERLY COMPASS - ASPIRA WEALTH – Q4 2024

In-depth stock market analysis from your wealth advisory team - Aspira Wealth from Victoria, BC. Written by Alex Vozian, co-founder, and portfolio manager of Aspira Wealth.

THE Big 5 TAKEAWAYS

- Long-term focus: U.S. and Canadian equities remain our top choice

We maintain our conviction that U.S. and Canadian stocks offer the strongest long-term growth potential for our clients. While current valuations in broad market indices like the S&P 500 appear elevated, this is largely due to a few large companies. Our diversified approach focuses on identifying value beyond these headline-grabbing stocks. We remain confident in the long term. - Disciplined approach: seeking value amidst market volatility

We are actively monitoring the market for opportunities to acquire shares of high-quality companies at attractive prices. A potential market correction, which we view as a healthy part of market cycles, could present such opportunities. Our clients' portfolios are well-positioned, with most established accounts nearly fully invested, while larger cash exposure in newer accounts is patiently deployed. Remember, long-term success comes from consistent investment ("time in the market"), not trying to predict short-term fluctuations ("timing the market"). - Prudent investing: prioritizing long-term stability

Our 2024 investment performance underscores our commitment to a disciplined, long-term approach. While we intentionally avoid chasing short-lived market trends, our equity and balanced strategies have delivered returns ranging from 11% to 30% in 2024. Some strategies trailed broad market indices in the short term, but our focus remains on building sustainable wealth over time for all the families we serve. We thoroughly analyze both our successful and less successful investments, using these insights to continuously refine our strategy while prioritizing long-term objectives. - Navigating a complex landscape: staying focused on fundamentals of the companies we invest in

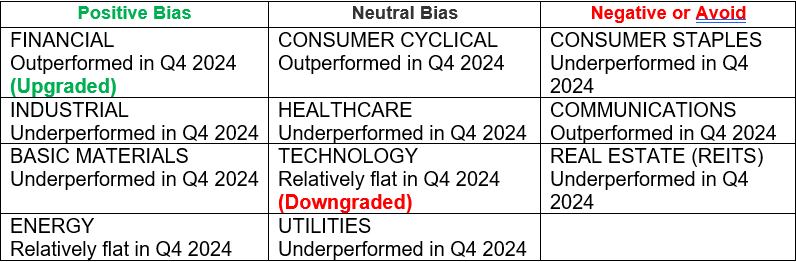

I don’t remember a noisier year than 2024 in my 20+ years as a professional investor: U.S. Treasury yield increased while the U.S. Fed cut interest rates; Biden was determined to run for President, and then decided not to; Trump promised major shifts in the internal and external policy, but then dialed down many of his intentions; aggressive hopes of companies like Microsoft and Google to monetize their AI investments as separate premium AI services, but then bundling AI into broader packages at a smaller incremental price. I chose to focus on more important things – the fundamentals of the individual companies we invest in. - We continue to favor investments in Industrial, Energy, Materials sectors, while also upgrading Financials to Positive (from Neutral)

We downgraded the Technology sector to Neutral (from Positive).

INVESTMENT PERFORMANCE – ASPIRA WEALTH IN-HOUSE STRATEGIES – RJL only

The performance reported below does not include RJLU numbers, due to compliance reasons. For RJLU clients, please check your individual accounts for performance reporting.

The 2024 returns in equity-only & preferred shares strategies of Aspira Wealth ranged from 12 to 30%, while the fixed income strategy finished the year with 5.4% gain.

It might have been one of the most difficult years to make investment decisions – markets had double digit returns in 2024 while investors had a lengthy list of reasons to stay prudent.

We place no weight on short-term results, good or bad, and neither should you. We believe that our long-term focus will serve us better.

Source: Aspira Wealth. *These numbers are relevant only for accounts with Raymond James Ltd. (Canada).

BROAD MARKET OBSERVATIONS

CANADIAN STOCK MARKET

- Q4 2024 was the second consecutive positive quarter for the Canadian stock market (S&P/TSX). The strongest sectors were technology and financials while the weakest were real estate and communication services.

- The Bank of Canada implemented two more interest rate cuts (total 100 bps) in Q4 2024, larger than earlier ones, because inflation pressure continued to moderate, and the economy was weaker than expected.

- The likelihood of a 10% decline in the market likely increased since our last update. One way to measure market optimism is to compare the market level (blue line) to its 3-year moving average (green line). As you can see in the chart below, the S&P/TSX index is now very “stretched” above the recent average, so we would not be surprised to see a few flat or negative quarters during the next couple of years.

Chart courtesy of StockCharts.com

U.S. STOCK MARKET

- Q4 2024 was the fifth consecutive positive quarter for the United States stock market (S&P 500). The strongest sectors were consumer discretionary, communication services, and financials. The weakest were materials, healthcare, and real estate.

- The S. Federal Reserve implemented a 25-basis points interest rate cut during Q4 2024. This was part of their ongoing efforts to support the labor market and stabilize the economy. The labor market was weakening in April-October 2024 but then accelerated in November and December. Inflation continued to ease, bringing it closer to the Fed's target, except for some acceleration in the last two months.

- The likelihood of a 10% decline in the U.S. market likely increased since our last update, like in the Canadian market, too.

Chart courtesy of StockCharts.com

USD CAD Exchange Rate

- The S. dollar appreciated significantly compared to the Canadian dollar since our last update but remained within its 10-year range of 1.20-1.50 CAD/USD.

- Since we expect it to stay in the same range in the long term, we are comfortable investing 50-75% of our Dividend Value Discipline portfolios in U.S. stocks, for a bigger diversification effect compared to the Canadian stock market.

Chart courtesy of StockCharts.com

Copper Price – one of the world’s leading economic indicators

- During Q4 2024, the copper price ranged $4.0-4.6. Copper price is assumed to predict turning points in the global economy, since it is widely used in most economic sectors. The current price level is not sending a clear positive or negative signal, as it remains volatile since 2021.

- We continue to believe that long term fundamentals of copper are great and expect copper prices to exceed $5 level during the next 3 years. New copper deposit discoveries are limited while the world needs a lot of copper to build and power electrical vehicles, as well as artificial intelligence data centres worldwide. The main negative for copper is that China (largest consumer of copper) is currently struggling with high debt, real estate issues and low consumer spending. Also, the government support for electrical vehicles was dialed down in multiple countries.

Chart courtesy of StockCharts.com

Semiconductors stocks – one of world’s leading economic indicators focused on the “new” economy

- We have a modest exposure to this space in The Dividend Value Discipline (TM) strategy.

- Q4 2024 was another volatile quarter for semiconductor stocks, as we expected, after multiple years of outperformance. The market participants are worried about excessive inventory in traditional semiconductor space, as well as worried about the long-term payoff of massive investments in AI space. Just a few days ago Google and Microsoft decided to lower the cost of their AI features, by making AI a part of a broader bundle of services (instead of charging a separate $20 or so monthly fee per user).

![]()

Chart courtesy of StockCharts.com

Crude oil prices

- In Q4 2024, the U.S. oil price (WTI) ranged $66-79, ending the quarter on a high note. The late Q4 2024 and early Q1 2025 strength is explained by increasing S. sanctions on Russia, continued efforts of OPEC+ to control the supply, as well as slower than expected growth in non-OPEC supply.

- We continue to expect U.S. oil price (WTI) to remain volatile, in the wide range of $60-100 per barrel. We think it is unlikely to go below $60 during the next 5 years, considering the low investments in production capacity in the past 10 years. We do not expect it to go above $100, because higher prices encourage larger supplies and given the efforts to transition to cleaner energy.

Chart courtesy of StockCharts.com

U.S. natural gas price

- In Q4 2024, the price of natural gas trended up from a low of $2.2 in October to a high of $4.2 in December. The latest price of $4.26 is the record high for the past 2 years.

- We expect it to stay in a wide range of $3-5 per MCF during the next 5 years (the natural gas prices are oscillating more than oil prices, due to exposure to the weather / heating season). This is an increase from our previous expected range of $2-5, because there is a new tailwind for natural gas – increasing power demand from data centers (AI), while alternatives (like nuclear plants) take a long time to build/restart.

Chart courtesy of StockCharts.com

WORRY JOURNAL - TOP WORRIES OF MARKET PARTICIPANTS AND BUSINESS LEADERS IN 2025

New worries:

Trump 2.0 - Tariffs / Immigration / Government Overhaul / Tax cuts.

- In 2024, voters in many countries sent a message of frustration by kicking out incumbents, including in the United States.

- Trump is currently advocating for major changes in many areas (trade, taxes, immigration, de-regulation, foreign policy, etc.). Most of you are likely worried about this uncertainty.

Our current thinking is as follows:

- Being loud during elections is an effective attention-grabbing strategy. Also, being aggressive before negotiations is occasionally helpful, too. We are currently seeing how many ambitious initiatives of the new U.S. administration are being dialed back: Ukraine war is no longer expected to end in one day but maybe 6 months; tariffs may not be applied across the board, but maybe in select strategic sectors; government cost cutting initiatives were dialed back,

- Not only are major changes to the policy difficult to implement, but also some initiatives would be very unpopular – if immigration and trade are restricted, it could reignite inflation, for example.

- We do not expect a major impact on Aspira Wealth investment strategies from the Trump 2.0 administration.

Older worries covered in detail in our recent publications:

- Israel – Hamas/Gaza military conflict is spreading in the region (2024+)

- Artificial Intelligence (AI) bubble (2024+)

- S. Elections (2024)

- Delay in S. interest rate cuts (2024)

- Nothing to fear but nothing to fear (2024).

- Risks and Dangers of Artificial Intelligence (AI) (2023+).

- 2023 Israel–Hamas war (2023+)

- Economic slowdown/recession (2022+)

- Debt ceiling debate/potential of a U.S. default (2023)

- War in Ukraine (2022+)

- Inflation (2021+)

- Supply chain disruption caused by the pandemic, geopolitical events (2020+).

- Labour shortages, attracting and retaining talent (2020+).

SECTOR POSITIONING FOR THE DIVIDEND VALUE DISCIPLINETM

- We are upgrading the FINANCIAL sector from Neutral to Positive, and downgrading TECHNOLOGY from Positive to Neutral.

- The rest of our assumptions and observations about each sector remain unchanged – you can find them in our previous publications.

Alex Vozian, CFA

Co-Founder and Portfolio Manager Aspira Wealth

January 16, 2025