THE QUARTERLY COMPASS - ASPIRA WEALTH – SEPTEMBER 30, 2024

In-depth stock market analysis from your wealth advisory team - Aspira Wealth from Victoria, BC. Written by Alex Vozian, co-founder, and associate portfolio manager of Aspira Wealth.

THE BIG 5 TAKEAWAYS

- We continue to believe that U.S. and Canadian stocks are the best investment class for the long-term investors

Some short-term volatility is possible after the strong rally that started in late 2023. Our long-term optimism is driven by multiple factors: (a) because inflation is largely defeated, many central banks around the world are no longer trying to slow down the economy, so they started cutting interest rates, while some governments also launched stimulus programs (China just launched a massive economic stimulus program last month), (b) elections’ uncertainty will likely go away by the end of 2024, (c) stock markets are typically strong in the fourth and first quarters of the year. - The performance of Aspira Wealth for the 9 months of 2024 is mixed, after a stronger performance in previous years

Three strategies are performing in line with our benchmarks, while our flagship strategy is underperforming so far in 2024. We place no weight on good (or bad) short-term results and expect our long-term focus to serve us better. The vast majority of Alex's and Chris’s personal investments are deployed in Aspira Wealth Strategies. We buy/sell the same securities, at the same time and price as we do for our clients. - News related to Israel and Ukraine are terrible from humanitarian perspective, but we expect our investment portfolios to be immune

Most of our clients have (a) exposure to safe-haven assets (bonds, gold, cash, real estate), (b) inflation protection (energy sector, and companies that can pass inflation to their consumers), (c) low (if any) exposure to trade disruption in the geographies mentioned above. - Nuclear power is back and we were early in the game – Cameco Corp is a holding since 2021

Global power demand is estimated to accelerate significantly in the next 5-10 years due to construction of new AI data centers. Current electric grids are struggling to keep up with demand, so Big Tech companies are now looking at nuclear power to meet the hefty demands of generative AI. The latest developments: (a) Palisades Nuclear Plant in Michigan has just secured a loan to restart operations at the shuttered plant, (b) Amazon has acquired Talen Energy's data center campus at a nuclear power station in Pennsylvania, (c) Microsoft has struck a deal with Constellation to source power from its retired nuclear plant in Pennsylvania, (d) TerraPower (founded by Bill Gates) has begun construction on its Natrium sodium-cooled fast reactor in Wyoming, (e) several small modular reactors are in different stages of development. - We continue to favor investments in Technology, Industrial, Energy, Materials sectors

We also upgraded our view on the Utilities sector to Neutral bias from Negative/Avoid bias.

INVESTMENT PERFORMANCE – ASPIRA WEALTH IN-HOUSE STRATEGIES – RJL ONLY

The performance reported below does not include RJLU numbers, due to compliance reasons. For RJLU clients, please check your individual accounts for performance reporting.

In the first nine months of 2024, the investment strategies of Aspira Wealth had a mixed performance. Three strategies generated a return between 5% and 8%, the other three strategies generated a return between 13-19%.

We place no weight on short-term results, good or bad, and neither should you. We believe that our long-term focus will serve us better.

Source: Aspira Wealth. *These numbers are relevant only for accounts with Raymond James Ltd. (Canada).

BROAD MARKET OBSERVATIONS

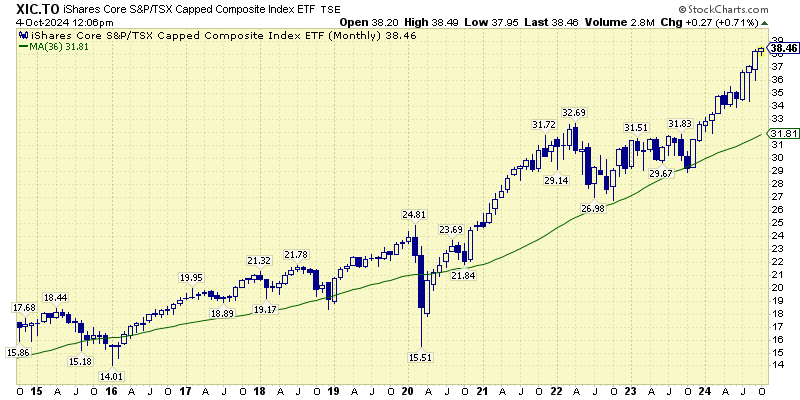

CANADIAN STOCK MARKET

- After a relatively unchanged Q2 2024, the Canadian stock market increased 10% during Q3 2024, surprising many investors, including us. Most of the strength was concentrated in the financial, real estate, utilities sectors, partially offset by the decline in the energy sector.

- Bank of Canada implemented 2nd and 3rd interest rate cuts in this cycle, after seeing continued progress with lowering of inflation rate. This is welcome news for a country experiencing economic slowdown and rising unemployment.

- The likelihood of a 5-10% decline in the market likely increased since our last update.

Chart courtesy of StockCharts.com

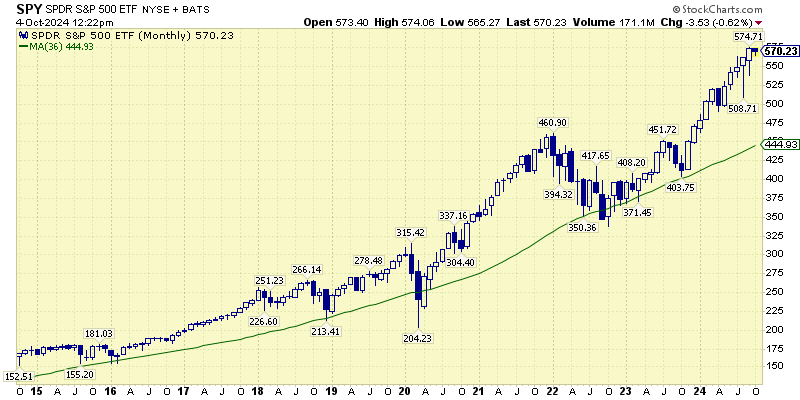

U.S. STOCK MARKET

- The United States stock market (S&P 500) has gained 6% during Q3 2024, with energy and technology sectors lagging, while utilities and real-estate sectors leading.

- The US Federal Reserve implemented its first interest rate cut (of 50 basis points) trying to navigate a “soft landing” for the economy. Labour market is healthy and less overheated than a few quarters ago. Inflation has continued to ease.

- The likelihood of a 5-10% decline in the market likely increased since our last update.

Chart courtesy of StockCharts.com

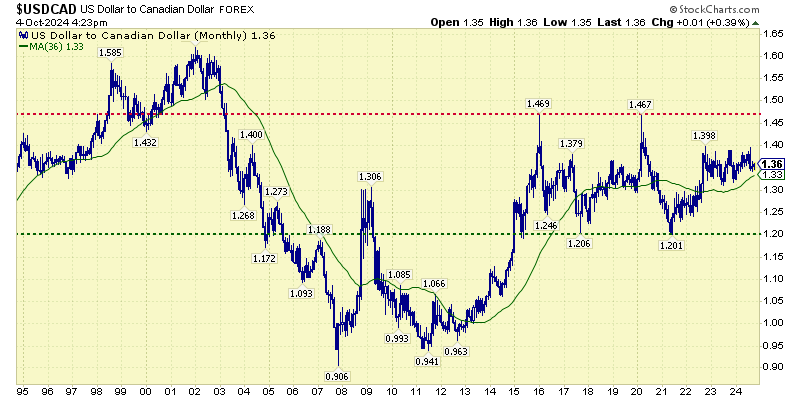

USD CAD Exchange Rate

- The USD CAD exchange rate has remained relatively unchanged since our last update. Over the past 30 years, the Canadian/U.S. dollar exchange rate was quite volatile, but it spent half of the time within the 1.20-1.50 CAD/USD range, including the last 9 years.

- Since we expect it to stay in the same range in the long term, we are comfortable investing 50-75% of our Dividend Value Discipline portfolios in U.S. stocks, for a bigger diversification effect compared to the Canadian stock market.

Chart courtesy of StockCharts.com

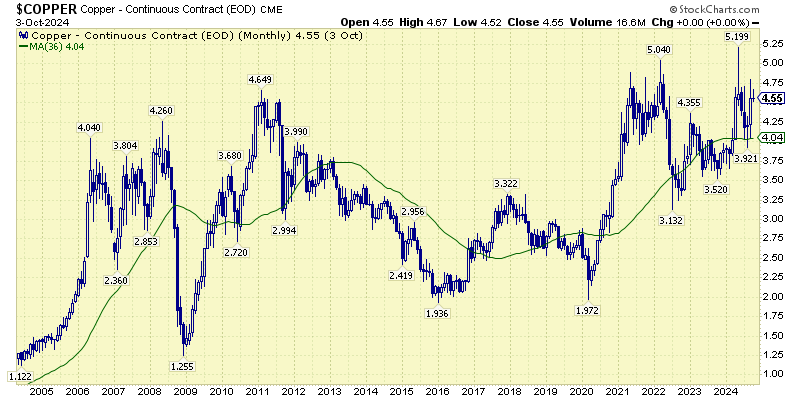

Copper Price – one of the world’s leading economic indicators

- During Q3 2024, the copper price dropped to as low as $3.9 and then quickly recovered to $4.8. Copper price is assumed to predict turning points in the global economy, since it is widely used in most economic sectors. The current price level is not sending a clear positive or negative signal, as it remains volatile since 2021.

- We continue to believe that long term fundamentals of copper are great and expect copper prices to exceed $5 level during the next 3 years. New copper deposit discoveries are limited while the world needs a lot of copper to build and to power electrical vehicles and as well as artificial intelligence data centres worldwide.

Chart courtesy of StockCharts.com

Semiconductors stocks – one of world’s leading economic indicators focused on the “new” economy

- Semiconductor stocks were very volatile in Q3 2024, as we expected, after multiple years of outperformance. The market participants are worried about excessive inventory in traditional semiconductor space, as well as worried about the long-term payoff of massive investments in AI space.

- We have modest exposure to this space in The Dividend Value Discipline (TM) strategy.

![]()

Chart courtesy of StockCharts.com

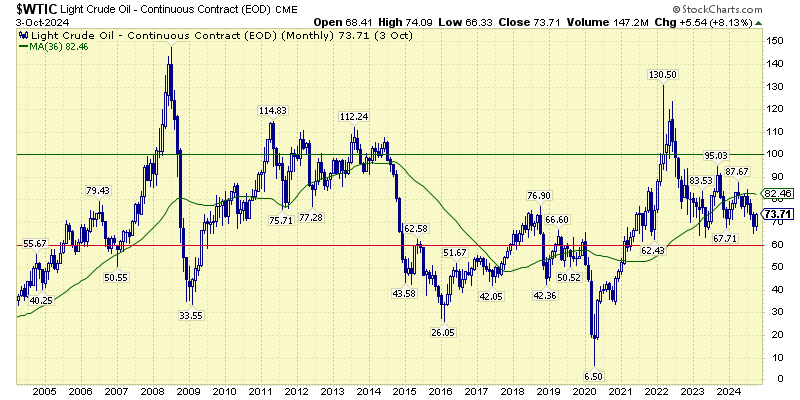

Crude oil prices

- In Q3 2024, the U.S. oil price (WTI) declined from the high of $85 in early July to the low of $65 in early September. The geopolitical escalation from the Middle East pushed the oil price back above the $70 level.

- We continue to expect U.S. oil price (WTI) to remain volatile but stay in the wide range of $60-100 per barrel. We think it is unlikely to go below $60 during the next 5 years, considering the low investments in production capacity in the past 10 years. We do not expect it to go above $100, because higher prices encourage larger supplies and given the continuous efforts to transition to cleaner energy.

Chart courtesy of StockCharts.com

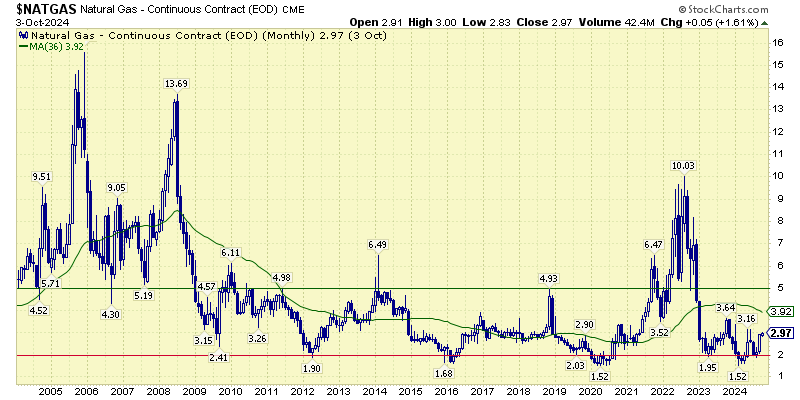

U.S. natural gas price

- In Q3 2024, the price of natural gas dropped to $1.9 in early August, and then increased to the $2.9 level in late September.

- We expect it to stay in a wide range of $2-5 per MCF during the next 5 years (the natural gas prices are oscillating more than oil prices, due to exposure to the weather / heating season). Given the North American growing export capacity and global transition away from coal/oil, we are biased to the upside.

Chart courtesy of StockCharts.com

WORRY JOURNAL - TOP WORRIES OF MARKET PARTICIPANTS AND BUSINESS LEADERS IN 2024

New worries:

- Israel – Hamas/Gaza military conflict is spreading in the region. While initial conflict from October 2023 started between Hamas and Israel, it gradually expanded (to a different degree) to other regions: Israeli-occupied West Bank, Lebanon, Syria, Iraq, Jordan, Yemen, Red Sea, Gulf of Aden, and Iran.

- Wars are the worst way to resolve conflicts - they lead to immense human suffering, economic devastation, and long-lasting social and political instability.

- Aspira Wealth investment strategies, however, are generally immune to current military conflicts around Israel, Ukraine, and other parts of the world.

- Most of our clients have (1) exposure to safe-haven assets (bonds, gold, cash, real estate), (2) inflation protection (energy sector, and companies that can pass inflation to their consumers), (3) low (if any) exposure to trade disruption in the geographies mentioned above.

Older worries covered in detail in our recent publications:

- Artificial Intelligence (AI) bubble

- U.S. Elections

- Delay in US interest rate cuts

- Nothing to fear but nothing to fear (2024).

- Risks and Dangers of Artificial Intelligence (AI) (2023+).

- 2023 Israel–Hamas war (2023+)

- Economic slowdown/recession (2022+)

- Debt ceiling debate/potential of a U.S. default (2023)

- War in Ukraine (2022+)

- Inflation (2021+)

- Supply chain disruption caused by the pandemic, geopolitical events (2020+)

- Labour shortages, attracting and retaining talent (2020+)

SECTOR POSITIONING FOR THE DIVIDEND VALUE DISCIPLINETM

- We are upgrading the UTILITIES sector from Negative/Avoid to Neutral bias, because of growing evidence that AI data centers are going to require an enormous amount of electricity – this is a massive tailwind for power producers.

- The rest of our assumptions and observations about each sector remain unchanged – you can find them in our previous publication

Positive Bias

TECHNOLOGY – AI - Caution.

Underperformed in Q3 2024

INDUSTRIAL

Outperformed in Q3 2024

BASIC MATERIALS

Relatively flat in Q3 2024

ENERGY

Underperfomed in Q3 2024

Neutral Bias

CONSUMER CYCLICAL

Outperformed in Q3 2024

HEALTHCARE

Underperformed in Q3 2024

FINANCIAL

Outperformed in Q3 2024

UTILITIES (UPGRADED!)

Outperformed in Q3 2024

Negative or Avoid

CONSUMER STAPLES

Outperformed in Q3 2024

COMMUNICATIONS

Relatively flat in Q3 2024

REAL ESTATE (REITS)

Outperformed in Q3 2024

Alex Vozian, CFA

Co-Founder and Associate Portfolio Manager Aspira Wealth

The information contained in this report was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete and it should not be considered personal tax advice. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views expressed are those of the author and not necessarily those of Raymond James. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. This provides links to other Internet sites for the convenience of users. Raymond James Ltd./Raymond James (USA) Ltd is not responsible for the availability or content of these external sites, nor does Raymond James Ltd/Raymond James (USA) Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd/Raymond James (USA) Ltd adheres to. Raymond James Ltd., Member—Canadian Investor Protection Fund. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions for which they are properly registered. Raymond James (USA) Ltd. is a member of FINRA/SIPC.